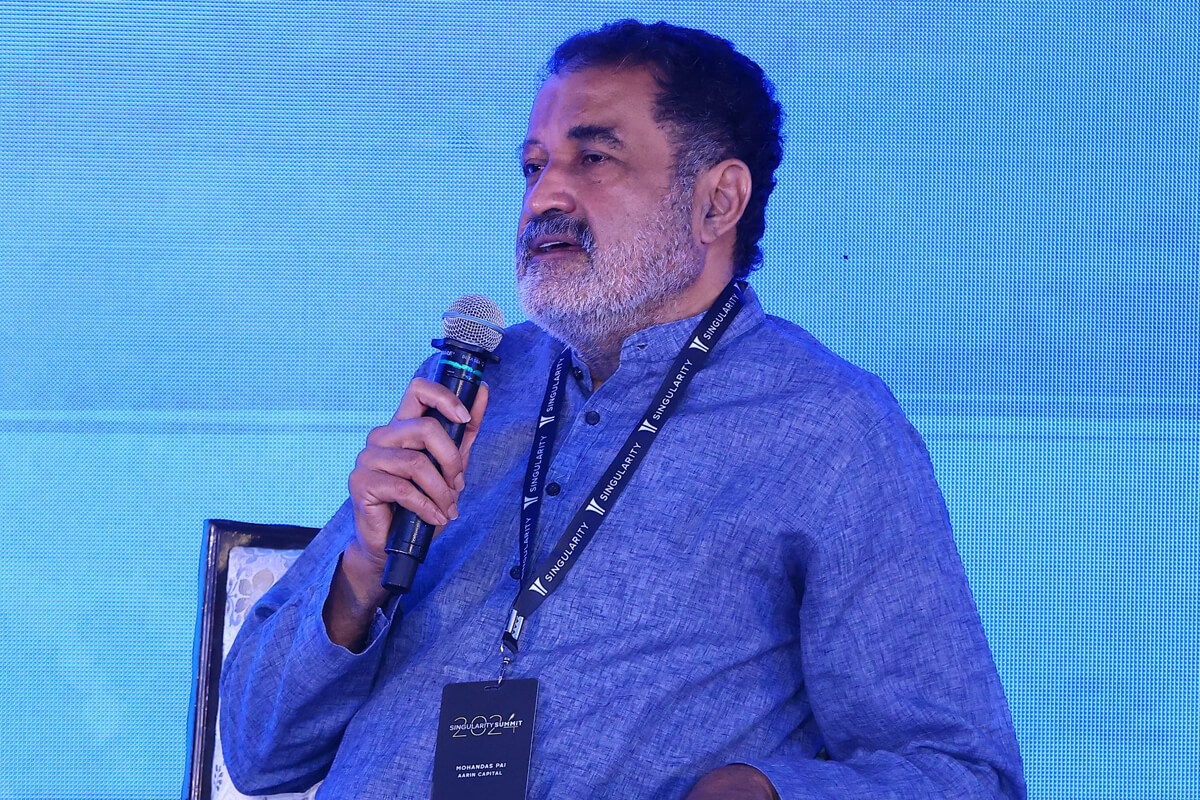

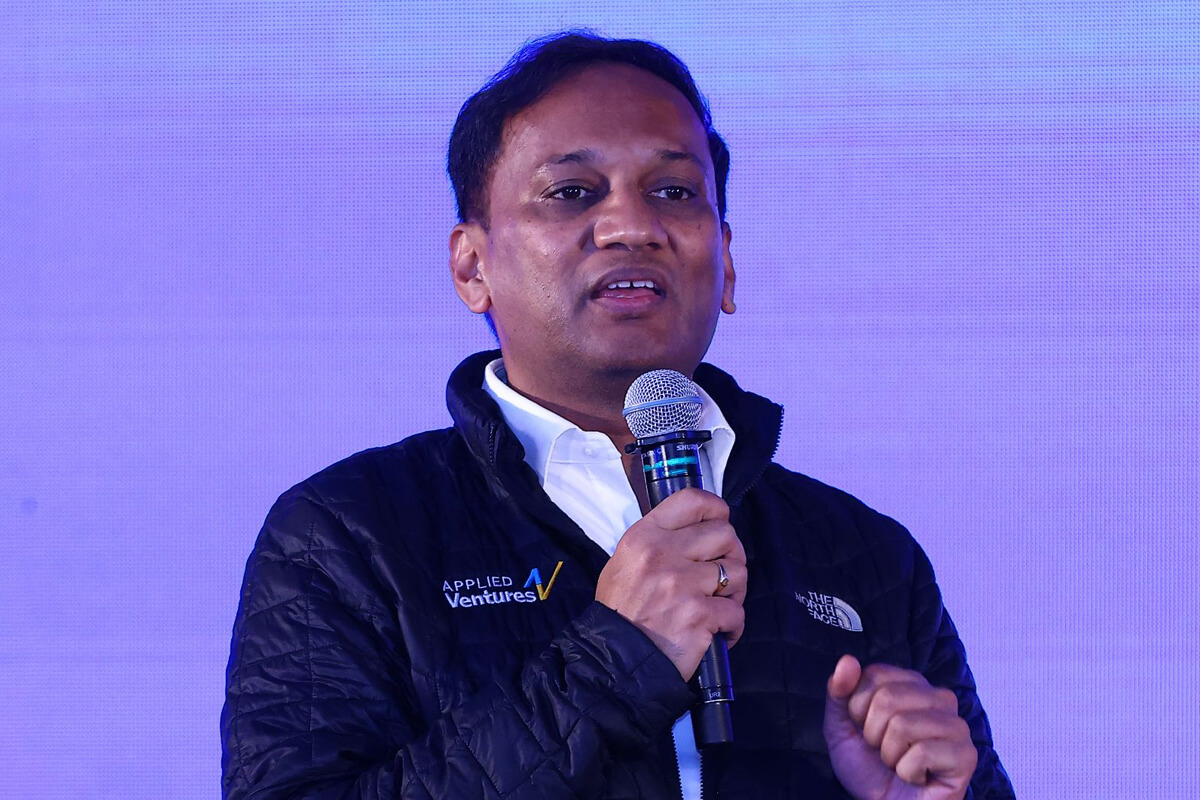

The inaugural edition of the annual Singularity Summit took place on 11 and 12 April 2024 at Taj Lands End, Mumbai. The Summit aimed to gather distinguished speakers, founders, wealth managers, and eminent personalities from the financial ecosystem under one roof to create a dialogue on the India Opportunity.

Over the course of 2 days, attendees got to experience insightful discussions, culminating in valuable takeaways. This inaugural Singularity Summit represents our ongoing dedication to fostering a strong, dynamic, and globally connected Indian community committed to growth and innovation!